Purpose of the document

This document describes the features of the Mercanet 2.0 solution.

Mercanet solution

More than just a payment platform, Mercanet is a true partner in the development of your online business. Since it was created in 1995, Mercanet has been continually evolving to expand its offering and meet your responsiveness, simplicity and security requirements.

Our solution offers you a simple or advanced mode depending on your use cases.

- Simple integration:

- Standard integration of the payment module

- Integration mode selection to adapt to your specificities

- Help with the integration and daily support

- A modular solution:

- Features at the service of your business (recurring/deferred/partial payment, etc.)

- Autonomous control of features chosen on an à la carte basis

Our platform makes the customer journey smoother in order to optimise the conversion rate.

- Payment interfaces for all situations:

- A unified multichannel experience, regardless of the terminal used (mobile, PC, tablet, etc.)

- Customisation of payment pages

- Services that suit the customer’s needs:

- A wide array of means of payment

- Quick, easy payment with OneClick payment

- Recurring payments

Our platform enables you to control your activity using efficient, secure tools.

- Intuitive business management:

- A single portal for accessing all modules

- A configurable, adjustable anti-fraud module

- A user-friendly transaction management module

- A comprehensive reporting tool:

- Visual dashboards that highlight your performance indicators

- Daily reporting for a better overview of your business

- Banking reconciliation

Overview

This chapter briefly describes the Mercanet interfaces. The latter provide your customer with a unified experience on all channels and easy management of your business.

A specific chapter describes their uses and features in greater detail.

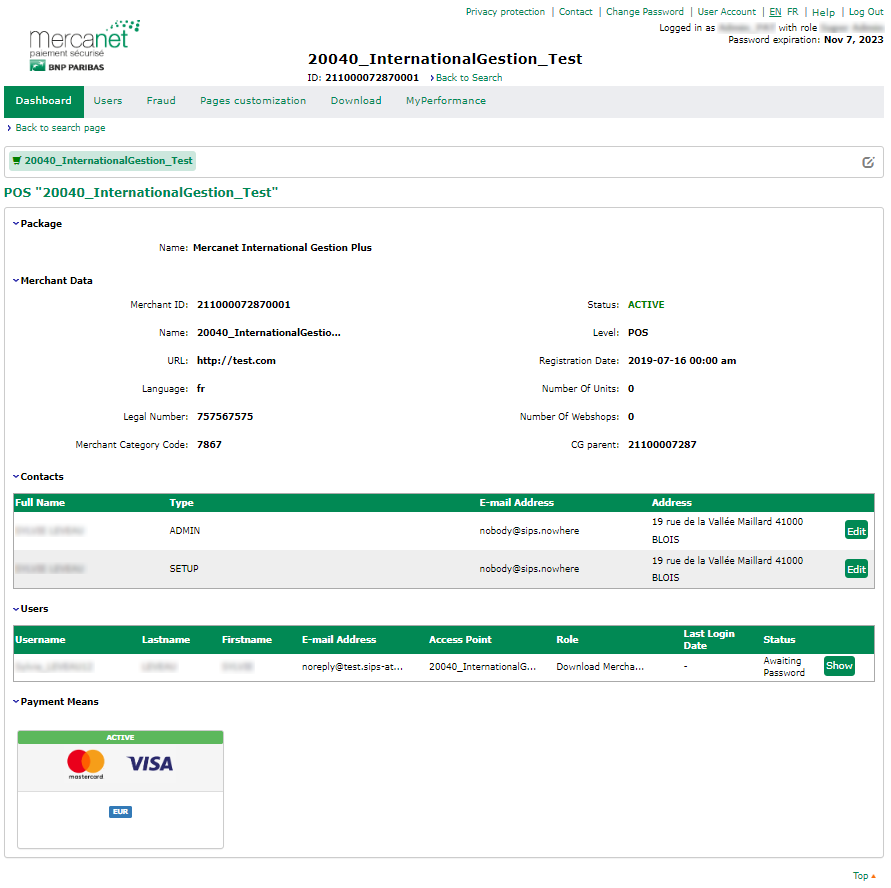

Merchant portal

To make our solution easier to use, we provide you with a portal that groups together the following applications, which you can access with a single username and password:

- Home: displays a summary of your data or those of the selected webshop

- Transactions: for viewing and executing operations on a webshop's transactions

- Users: administration of the users associated with you and your webshops

- Fraud: configuration of anti-fraud tools

- Customisation: for customising the look of the payment pages on which customers enter their data

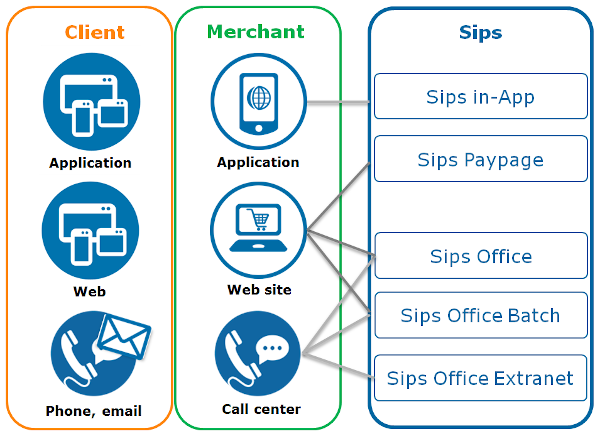

A multichannel solution

Mercanet is a flexible solution that can adapt to any sales channel: Internet, MOTO, mobile devices and e-mail.

For each channel, Mercanet has various interfaces that provide you with homogeneous, unified management of your payments.

Payment interfaces

Mercanet meets your needs with an array of interfaces that suit your business, your organisation and the option you chose regarding compliance with PCI DSS constraints (see the “Security” chapter).

This choice primarily depends on the hosting you choose for your payment pages:

- Your customer is redirected to the payment page hosted by BNP Paribas -> Paypage with or without iFrame.

- The payment page is hosted by you -> Office (M2M).

- The payment is made via an application -> In-App.

Requests can be sent 24 hours a day regardless of the interface used.

Summary

| Payment page | Paypage | iFrame | Office (M2M) | In-App |

|---|---|---|---|---|

| Hosting | BNP Paribas | iFrame container page: merchant iFrame content:

BNP Paribas |

Merchant | Merchant |

| PCI DSS compliance | BNP Paribas | BNP Paribas | Merchant | Merchant (streamlined) |

| Customisation | BNP Paribas CSS | iFrame container: merchant iFrame content: via

CSS |

Merchant | Merchant |

| Means of payment | All | CB, Visa, MasterCard, VPay, Maestro, Electron, Amex and Bancontact | Most (cf. means of payment documentations) | CB, Visa, MasterCard, VPay, Maestro, Electron, Amex and Bancontact |

| 3-D Secure | BNP Paribas | BNP Paribas | Merchant | Merchant |

Transaction management and reporting

Mercanet enables you to easily manage all your payments regardless of the channels or means of payment your customers use.

Office (M2M) enables you to create payment transactions, but also to perform transaction management operations (refunds, cancellations, etc.).

You can also view and manage your transactions through a dedicated extranet, Mercanet Back Office.

| Mercanet interface | Transaction creation | Transaction management |

| Paypage | Yes | No |

| In-App | Yes | No |

| Mercanet Back Office | Yes | Yes |

| Office (M2M) | Yes | Yes |

| Office Batch | Yes | Yes |

To improve and automate tracking, the following reports can be sent to you:

- Transactions reports

- Operations reports

- Reconciliations reports (depending on the acquirer)

- Chargebacks reports (depending on the means of payment and the acquirer)

Payment methods

Mercanet assists you in your development in France and abroad thanks to its connections with acquirers in over 40 countries, and its many domestic, international and alternative means of payment.

Cards

Interbank and charge cards refer to the cards issued by predominantly international networks. This type of means of payment is the most widely used in the world of e-commerce, with a predominance of the international Visa & MasterCard networks, which coexist with domestic networks (CB for France, Bancontact for Belgium, etc.).

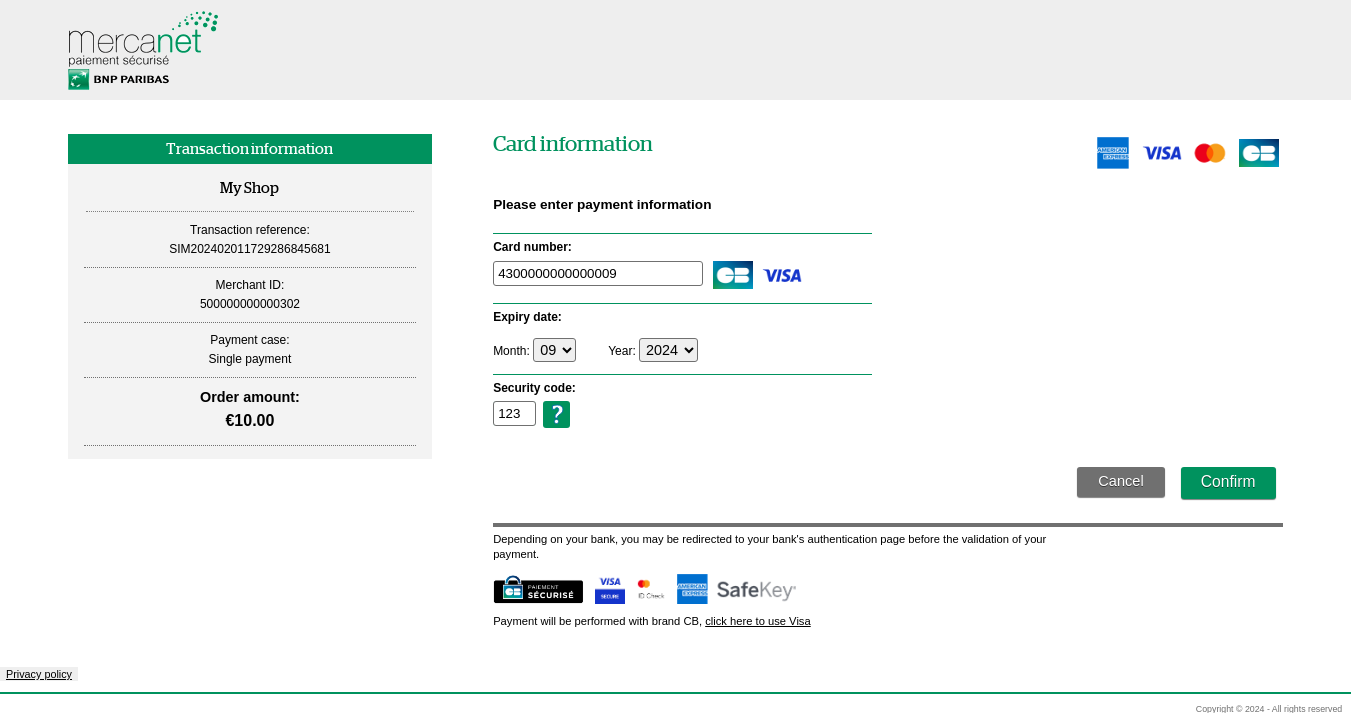

The Mercanet solution is subject to the European MIF regulation. One of its rules, “Brand Selection”, requires that you let a customer who holds a co-branded card choose the brand at the time of payment. A co-branded card supports at least two brands. Most of the cards issued in France are co-branded with CB (CB/VISA, CB/MASTERCARD, CB/MAESTRO, etc.). By way of illustration, the screen below shows an example of a co-branded CB + Visa card with CB as the default brand. The customer can switch brands by clicking on the link at the bottom of the screen.

Mercanet enables your customers to use the following cards:

- CB

- Visa

- MasterCard

- Electron

- Maestro

- VPay

- American Express

- Bancontact

Online credit, private cards and gift cards

To enable your customers to benefit from payment facilities, Mercanet provides online credit solutions and payment facility offers that are or are not affiliated with cards. These solutions are mostly issued by banking networks. Payment facilities options vary according to the solutions and the private networks that issue them.

Mercanet notably provides you with the means of payment from the following issuers:

- Cetelem

- Franfinance

Debit

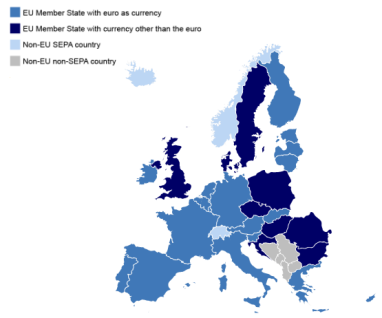

The SEPA Direct Debit (SDD) is a means of payment available as part of the SEPA (Single Euro Payment Area), which aims to unify and simplify all means of payment in Europe. It represents a major and essential evolution of payment in Europe. In this context, BNP Paribas has developed "SPS", a comprehensive platform for managing SEPA mandates and direct debits. The platform is connected to Mercanet and thus provides a complete SDD solution.

External wallet

The wallet is a virtual account for storing money and/or means of payment. Wallets make the payment process smoother.

Mercanet notably provides you with the following wallets:

- PayPal

- Apple Pay

- Google Pay

- Samsung Pay

Mobile payment

The mobile payment market has evolved significantly in the last few years and offers a widely diversified range of solutions.

For example, with Mercanet, you can propose to your customers to use:

- Bancontact mobile

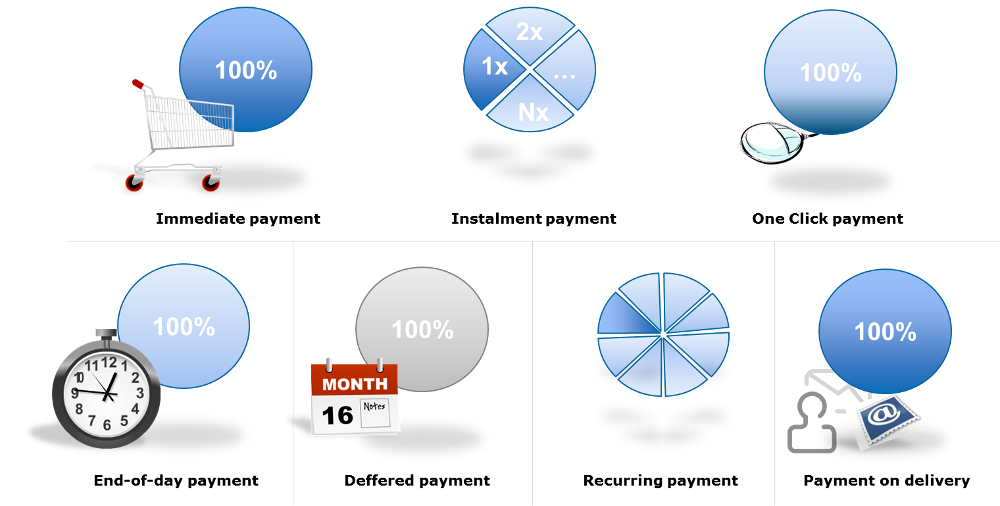

Payment terms

Thanks to Mercanet, you can provide your customers with a great variety of payment terms. Some of them are not applicable to all means of payment.

End-of-day payment

In the case of an end-of-day payment, the authorisation request is sent online during the purchase, and all the transactions accepted during the day are captured at the end of the day.

This mode applies to the means of payment that operate in “dual message" mode (i.e. one message for the authorisation, and another for the capture). It applies especially if you are sure that the products paid for are available on your site, because the customer's account is debited on the very same day.

Deferred payment

With deferred payment, you set a maximum capture time in days. The capture is performed in accordance with the selected capture mode:

- In automatic capture mode (or “Cancellation” mode), the transaction is captured when the capture deadline is reached.

- In “Validation” mode, the transaction is captured at any time, when you choose to do so.

Deferred payment enables you to schedule the deadline on which your customer's account will be debited. This deadline can be brought forward if needed.

Payment upon shipment of the goods

In the case of payment upon shipment of the goods, the transaction is captured following your validation. You specify the validity period of your transaction in your request. If you do not validate a given transaction before this period ends, this transaction expires. If you forget to validate the transaction in time, you can submit the transaction again using the duplication operation. You can validate all or part of the transaction amount; however, you cannot validate an amount greater than the initial amount of the transaction.

Payment upon shipment of the goods enables you to debit your customer's account only if you are sure that you can deliver the order.

Payment in instalments

Payment in instalments enables you to create multiple instalments associated with a transaction, in a single payment request.

You can split a transaction into several instalments that will be captured at fixed intervals. In this case, a payment transaction with N instalments generates N transactions, each of which has a distinct ID. Each transaction in the schedule is independent of the others and is subject to a systematic authorisation request, issued on the day the customer is debited. If it is refused, the transaction is not captured and the client will not be debited.

You must be careful when offering payment in multiple instalments:

- There is no guarantee that subsequent instalments will be paid.

- A lost or stolen card or a card with insufficient credit might cause substantial losses for you.

- If the first transaction has been authenticated using 3-D Secure, the following instalments cannot benefit from the liability shift.

Operating guidelines

- If the authorisation for the first instalment is rejected, subsequent instalments will not be created.

- If the authorisation of one of the subsequent instalments is rejected, the following instalments remain valid.

- If the authorisation of one of the subsquent instalments is rejected following a technical issue (e.g. acquirer authorisation server is unavailable), this instalment will be automatically submitted again on the next day.

Recurring payment

Recurring payment enables you to make automatic payments at regular intervals without the customer's presence. Recurring payment is very useful to manage subscriptions.

You can generate a recurring payment from:

- a wallet. The means of payment is already saved and can be reused easily

- an existing transaction. Using the duplication operation you can make recurring payments without having the card number, or you can propose payment when upselling, without any extra data entry by the customer. Duplication can be automated with Office (M2M) or Office Batch

- the customer's Primary Account Number (PAN). You can create recurring payments by specifying the customer's PAN. (e.g. card number). However, this process requires that you provide the customer's personal data, thus forcing you to comply with the PCI DSS security standards in force

Immediate payment

In the case of immediate payment, the transaction is stored during the online authorisation. This payment term is used more rarely, and only for the means of payment that support the "single message" mode (i.e. single message for both the authorisation and the payment). This is the case, for example, of “online banking"-type methods that redirect the customer to their bank's website.

Batch payment

Batch payment is a deferred exchange of information (in file mode) between you and Mercanet. It allows you to create transaction and/or operation files and then upload them to a secure Mercanet FTP Account.

It is therefore different from a number N of information communicated in real time (transaction mode).

Mercanet wallet

The wallet aims to:

- simplify the online payment journey with OneClick payment

- make subscription payments without PCI DSS constraints

The Mercanet wallet supports multiple channels, merchants and means of payment:

- Multiple channels: a wallet can be created and used with different types of interfaces, thus adapting to the customer journey

- Multiple stores: the customers’ IDs and their stored cardholder data can be shared by several stores of the same merchant

- Multiple means of payment: the wallet supports several of means of payment

The data of the means of payment are directly supplied by the customer and stored by Mercanet. Therefore, you do not have to convey them, which frees you from PCI DSS constraints.

The table below describes in detail the options available in the wallet for every interface:

| Interfaces | Create a wallet | Delete a wallet | Add a means of payment | Delete a means of payment | View wallet data | Pay with a wallet |

| Paypage | Yes | No | Yes | Yes | Yes | Yes |

| Walletpage | Yes | Yes | Yes | Yes | Yes | No |

| Office (M2M) | Yes (PCI constraint) |

Yes | Yes (PCI constraint) |

Yes | Yes | Yes |

| Office Batch | Yes (PCI constraint) |

Yes | Yes (PCI constraint) |

Yes | Yes | Yes |

| Mercanet Back Office | No | No | Yes | Yes | Yes | No |

OneClick

The OneClick option facilitates and speeds up the customer journey during online wallet payments via the Paypage interface.

When they make their first purchase on your site, the customer can opt for this payment facility by checking the relevant box. You must first specify, in the payment request, a wallet ID to be created.

When the customer uses the card payment method, 3D-Secure authentication of the cardholder is carried out when the card is enrolled, in accordance with DSP2.

If you provide the wallet ID when making future purchases on your site, the OneClick payment will be offered to the customer. The default means of payment already stored in the wallet is offered. The customer can confirm it, choose another means of payment stored in the wallet, or decide to pay with a new means of payment that they can also save. This solution complies with the PCI DSS standards since the means of payment are stored by Mercanet in a PCI DSS-certified environment.

Using strong authentication and the 3-D Secure programme on OneClick processes can lead to a more seamless custom experience by not requesting your customer to enter their card security code on the payment pages (available for the CB/VISA/MASTERCARD means of payment and provided that your acquirer supports this feature).

Walletpage

The saving and management of the wallet by the customer can be dissociated from the payment process.

You can redirect your customer to the Walletpage pages where they can save one or more means of payment online without having to make a purchase. The customer can also access the Walletpage pages to view, modify or delete the means of payment already saved. The Walletpage pages share the same graphic charter as the one defined for the Paypage pages, which makes customisation easier for you.

Subscription

The wallet also makes recurring payments easier. You can use it to make payments without the customer's presence while freeing yourself from PCI DSS constraints. These payments can be made in bulk using the Office Batch connector.

Multicurrency payment

Mercanet can accept all currencies provided that your acquiring contract accepts them. This contract enables payments to:

- either be converted into a single currency when your account is credited

- or be created in the acceptance currency, which is displayed to the customer

Payment in the merchant's currency

During the acceptance phase, Mercanet sends the currency code in the authorisation request and in the transactions captured by the acquirer. The acceptance process is carried out using the original currency (currency of the holder’s card). When acquiring (capturing) payments, if your payment is made in Euros, the acquirer makes the conversion into Euros. The conversion details are provided in the Reconciliations reports (depending on the acquirer).

Payment in the original currency

During the acceptance and acquiring phases, the process is carried out in the original currency (currency of the holder's card). No currency conversion is performed. The various amounts (gross, net, and commissions) are specified in the original currency in the Reconciliations reports (depending on the acquirer).

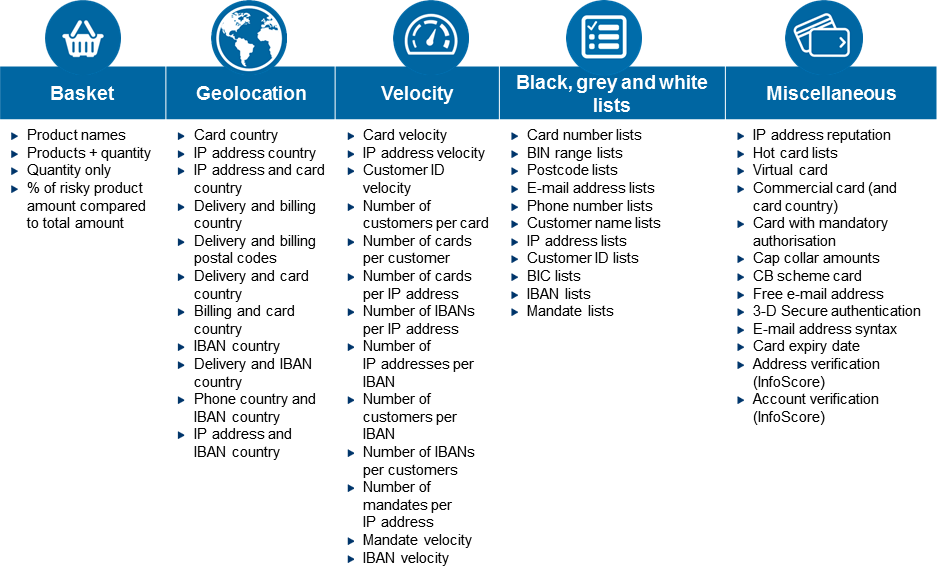

Risk management

Detect a risk of fraud with the Go-No-Go solution

The Go-No-Go solution makes it easy to limit the risk of fraud. This solution is based on checks that block the transaction if needed.

Mercanet offers two modes:

- Go-No-Go -> the most common checks (18 rules)

- Go-No-Go + -> extra checks (72 rules)

An interface accessible from the Merchant Extranet enables you to directly configure the checks that should be performed, in accordance with your business. The checks added or modified from this interface are effective immediately.

Benefits of 3-D Secure

Thanks to the 3-D Secure service (referred to as "CB Paiement Sécurisé", "Visa Secure", "MasterCard Identity Check", "Bancontact EMV 3DS" and "American Express Safekey" by CB, Visa, MasterCard and American Express, respectively), the cardholder is also authenticated as part of the payment transaction. The bank that issued the card and the network (CB, Visa, Mastercard, Bancontact or American Express) are involved in this authentication.

The programme has several advantages:

- The customer makes the payment secure by providing their bank with additional data.

- You are sure that your customer is indeed the cardholder since they have been authenticated by their bank.

Authentication via 3-D Secure is fully integrated into the Paypage interface and requires no additional development for you. With the Office (M2M) interface, you can have us process both the authentication and authorisation flows, or only one of them (the other one may be handled by another PSP).

For this type of transaction, you can benefit from the payment

guarantee under conditions that depend on the banking regulations in

force. The liability shift which you benefit from is specified in the

GuaranteeIndicator field of the

Mercanet reports. It is not systematic and must not

replace the anti-fraud checks you set up. An excessive rate of chargebacks

might jeopardise your acceptance of means of payment.

Moreover, 3-D Secure cannot handle all payment processes. 3-D Secure cannot be used for:

- deferred payments of more than 6 days

- payments in multiple instalments or captured in multiple instalments

- recurring transactions (e.g. created through the duplication function)

- non-Internet payments (manual entry by the merchant, created by the merchant, etc.)

Anti-carding system

E-commerce sites can be the targets of carding operations. Carding is used by fraudsters to check the validity of card numbers that were stolen or generated fraudulently by creating mass fake transactions. Mercanet’s anti-carding system can detect carding attacks, can alert you, and can combat these attacks (additional fraud checks, etc.).

Transaction management

Transaction management consists in creating or modifying a transaction carried out using Mercanet. The transaction management tools enable you to perform operations on transactions up to 18 months after their creation (period during which the transactions are stored in the database). Mercanet provides three management interfaces: Mercanet Back Office, Office (M2M) and Office Batch.

The available features enable you to optimise your management and improve the service provided to customers (e.g. debit upon shipment of the goods).

These management interfaces allow for:

- the total or partial cancellation of transactions before they are captured

- the total or partial validation of transactions so they are captured

- the total or partial refund of transactions that have already been captured

- the creation or duplication of transactions

Some means of payment may have management rules that do not allow all transaction management operations.

Transaction ID

A transaction is identified by a unique reference per shop. This reference is valid throughout the transaction life cycle. This reference enables you to manage your payments. It is accessible on all the interfaces, reports and reporting tools at your disposal.

Creation

In a payment request, you choose the payment options that best suit the services you want to provide your customers with.

| Field | Comment |

paymentPattern |

Type of payment (one shot, initial payment, recurring payment, etc.) |

orderChannel |

Order channel used (Internet, MOTO, Fax, etc.). Internet is the default. The use of this field must match the conditions defined in the acquirer contract. |

fraudData |

Transaction anti-fraud rules settings allowing you to dynamically customise the rules saved in your shop configuration. |

captureMode |

Transaction capture mode:

|

captureDay |

Capture time before the transaction is captured. This time

is set in days. It makes it possible to provide same-day (captureDay = 0) or deferred (captureDay > 0) payment. |

Cancellation

This feature makes it possible to cancel the transaction fully or partially before capturing it. Partial cancellation enables you to modify the amount to be captured. This feature is useful if you need to make sure the products are in stock.

If a customer has ordered several products, you can partially cancel the amount for an unavailable product to debit the customer's account only with the amounts of the products actually delivered.

The cancellation of a transaction must take place before this transaction is captured. If the transaction has already been captured, cancellation is not possible. You can still refund your customer fully or partially.

A transaction in instalments can be cancelled, as long as the day on which the payment is due is not reached and the transaction balance is not null. In the case of a partial cancellation, the transaction balance automatically goes into payment when the capture deadline expires.

When a cancellation is requested, the Mercanet server checks two parameters:

- amount -> you cannot cancel an amount greater than the original amount of the transaction

- capture deadline -> this parameter was defined at the time of the authorisation request. When this deadline is exceeded, the transaction is captured and can no longer be cancelled

A request for an adjustment to the authorisation limit of the cardholder's card is made if this functionality is supported by the acquirer.

Validation

The validation feature makes it possible to trigger the transaction capture. It thus enables you to provide deferred payment by debiting your customer’s account when the purchased products are shipped. When the “Validation” mode is chosen, each transaction must be validated so it can be captured. If you do not validate a given transaction before its capture time expires, this transaction expires. It will then be impossible to capture it. If you fail to validate the transaction in time, you will be able to submit the transaction again through the duplication operation. You can validate all or part of the transaction amount. The validated amount will be paid on the day it is validated. You cannot validate an amount greater than the original amount of the transaction.

Refund

A refund makes it possible to credit the account of a customer who has previously been charged (product not received, unavailable, damaged, return, etc.). The refunded amount is credited to the customer's account, and the same amount is debited from your account. The refund is captured on the same day as the operation. You can refund a customer up to 18 months after their order. You can make as many partial refunds as you want as long as you do not exceed this 18-month maximum period and the cumulative amount of refunds does not exceed the amount of the original transaction.

A feature makes it possible to prevent the refund of a transaction whose status is "chargeback". This status appears on the extranet.

From now, cash operations (refund, credit holder) are subject to an authorization request.

Duplication

You can create a new transaction from an old one if you know its reference. The duplication of a transaction is possible up to 18 months after its creation date and within the limit of the expiry date of the means of payment. The transaction created during the duplication phase is a new transaction, all characteristics of which can be changed except for the card information, which you do not need to store in your information system. A transaction created by means of a duplication can in turn be duplicated. The duplication of a transaction results in a new authorisation request based on the payment data (card number, account number, etc.) corresponding to the original transaction. The outcome of the duplicate transaction does not depend on the outcome of the original transaction: if the original transaction was rejected, it may be accepted after duplication, and vice versa. A transaction associated with a payment in multiple instalments can be duplicated. The payment for this new transaction will be made in one single go.

Duplication thus enables you, for example, to rectify a transaction that was not validated because of an error or oversight, or a transaction that was rejected.

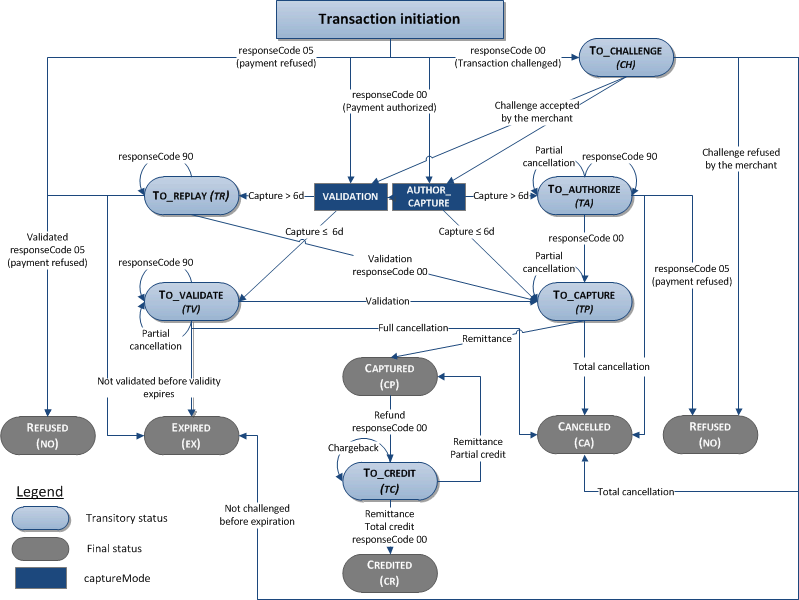

Life cycle

The operations affect the status of the transaction. The following diagram shows all the possible statuses of a Visa or MasterCard transaction life. This diagram is the most comprehensive one; however, depending on the means of payment, the life cycle can be much simpler.

| Status | Comment |

| CANCELLED | The transaction has been totally cancelled by the merchant. |

| CAPTURED | The transaction has been captured by the acquirer. |

| CREDITED | The transaction has been totally refunded by the merchant. |

| EXPIRED | The transaction has expired. |

| REFUSED | The transaction has been rejected. |

| TO_AUTHORIZE | Awaiting new authorisation request before capture. |

| TO_CAPTURE | Awaiting capture. |

| TO_CHALLENGE | The transaction is to be verified by the merchant following an orange fraud score. |

| TO_CREDIT | Awaiting capture to credit the customer's account. |

| TO_REPLAY | Awaiting new authorisation request before capture. |

| TO_VALIDATE | Awaiting the merchant's validation before capture. |

Capture

Capture, which consists in crediting your account and debiting the customer's (or vice versa in the case of a refund) is triggered by Mercanet every night. Then each bank is free to credit your account on a given value date. The payment of your transactions depends on the chosen capture mode (validation, cancellation or immediate) as well as the capture time you have specified.

You can find the hours of capture in this table.

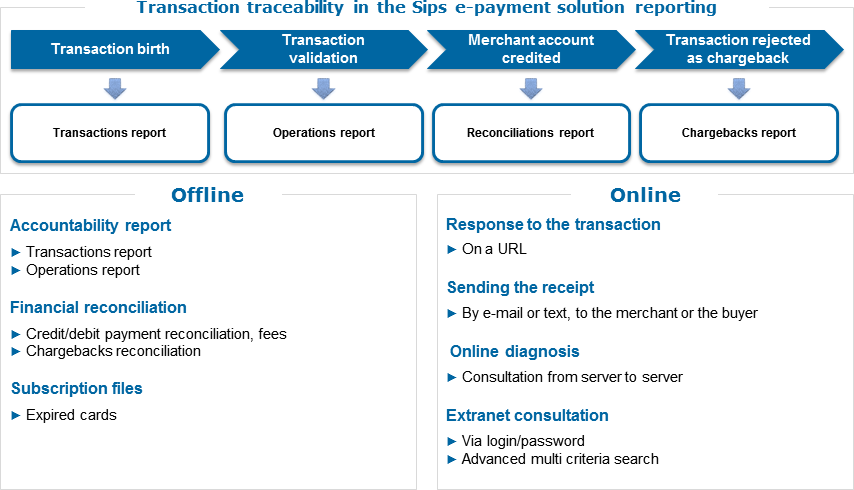

Reporting

The Mercanet reporting is feature-packed. Several tools enable you to track the transactions made on your shop: automatic and manual responses, the Transactions and Operations reports, the transaction viewing tool (Mercanet Back Office), the Reconciliations report, and the Chargebacks report.

Online reporting

Mercanet sends notifications to you and your customer.

Merchant notification

When you use Paypage, you are informed in real time of the response to the transaction. The manual response is sent to you when the customer is redirected to your site after the payment or wallet management. On the other hand, the automatic response is sent whether the customer returns to the shop or not. Besides, if your server is temporarily unavailable, multiple attempts to send the response are made (for more information on this option, please refer to the 'Online reporting > Automatic response' section of the functionality set-up guide). In addition, you can request an e-mail confirmation, which will enable you to compensate for any loss of Internet connection. The e-mail confirmation will be identical to the one possibly sent to the customer.

Customer notification

If you so wish, the customer can receive, in addition to the payment receipt, an e-mail or text message receipt that confirms the outcome of the transaction. Of course, the receipt sent via e-mail can be customised. It can be sent in plain text or HTML format, and can include images.

The receipt sent via text message is shorter. It includes the most important information of the transaction and can be useful in the case of a payment via Paypage, since the customer did not necessarily provide an e-mail address.

In addition, for Web and Mobile solutions, a button on the receipt page enables the customer to return to your shop. If this action is performed, Mercanet will send you the result of the transaction again so you can adapt your page content. You can thank the customer for their purchases or, conversely, suggest another means of payment to them.

Diagnostic

To know the detailed status of a transaction, you can also send a diagnostic request on it. This request can be useful, especially if you have not received a manual or automatic response.

Extranet

To improve transaction tracking, you can also view the payments made on your webshop, through Mercanet Back Office.

You can view:

- a single transaction from its number, the PAN, and the transaction date

- a transaction list, based on a set of criteria (transaction number, date, merchant reference, transaction status, card type, currency, etc.). The results page enables you to view all the information related to a specific transaction

Offline reporting

For most merchants, reports are sent once a day between 4:00 a.m. and 6:00 a.m. This information is usually sent as an e-mail attachment in CSV format. The data may also be sent via FTP, for large files for example. When your files regularly exceed 10 MB, we recommend choosing the FTP sending mode.

The Transactions report informs you of all the payments made on your site (whether they were accepted or rejected). From this report, you can decide to deliver all the orders the payment of which was accepted.

The Operations report informs you of the evolution of the transactions life cycle. The report includes the list of cash management operations (validation, refund) as well as the captured transactions if you so wish.

This report is the result of the reconciliation between the transactions stored by Mercanet and the payment results returned by the acquirer or the financial institution after the transactions were captured. Mercanet processes these results to enrich the acquirer’s data with the Mercanet context of the transaction (transaction number, merchant-specific references, etc.). This report lets you know whether each transaction was actually credited by your acquirer/banking institution. The Reconciliations report consolidates the financial view of the various means of payment accepted by your shop.

This report is the result of the reconciliation between the transactions stored by Mercanet, and the chargebacks (for example due to a customer dispute) reported by the acquirer or the financial institution. This return flow is processed by Mercanet to enrich the acquirer's data with the Mercanet context of the transaction (transaction number, merchant-specific references, etc.). Thus you get detailed chargeback information and you can manage your customer reminders accordingly.

This report includes all the cards saved in your wallets and that will expire within a specific period of time (between one and three months).

Your interfaces

Payment pages hosted by Mercanet: Paypage

Paypage is an interface that supports the global payment process in a secure way. From the page used to select the means of payment to the display of the receipt, the entire data entry is carried out by Mercanet servers, thus guaranteeing simplicity and security. Paypage includes all Mercanet features already available on the Web and is enriched with new multichannel media: touchscreen tablets, interactive TVs, ATMs/banking machines, etc.

Choice of means of payment

By default, Mercanet displays the logos of the means of payment you set up on your site. Thanks to the transaction details (basket amount, foreign customer, etc.), and if you so wish, you can then display a reduced list of means of payment (e.g. credit cards, PayPal). If you only accept bank cards as means of payment, this intermediate page is then "bypassed" and the payment information entry page is displayed directly.

Receipt

By default, Mercanet displays the payment receipt and specifies the important data of the transaction (amount, reference, authorisation number, etc.). You can, however, display the receipt directly on your site.

Capture card details using the device camera ("Scan and Pay")

The showing of the card by a customer to their mobile allows:

- on the one hand, them to automatically fill in the fields relating to the card number and the expiry date

- on the other hand, you to increase your conversion rate

This feature does not require any action on your side when calling Mercanet, nor any activation; it depends only on the user's (mobile) environment. If your customer's device and card are compatible with this feature, it will be possible for them to capture the card details using the camera of their device.

All Mercanet payment pages support the HTML auto-complete feature for the following fields:

- card number (PAN) ("cc-number" auto-complete)

- month of the expiry date ("cc-month" auto-complete)

- year of the expiry date "cc-year" auto-complete)

- cardholder's name ("cc-name" auto-complete)

Among the many sites describing this HTML feature, you may refer to this site.

However, the feature is dependent upon elements not covered by the Mercanet support:

- device version and type (please refer to the manufacturer's documentation)

- operating system version (please refer to the editor's documentation)

- user setting of the device (hardware and software configuration according to the documentation)

- restrictions from possible third-party layers (phone provider/vendor layers, corporate security settings…)

- card recognition by the hardware and software devices (should you have any questions, please contact the relevant manufacturer and editor)

Mobile phone payment application: In-App

If you have developed a specific mobile application to provide your customers with a fully integrated journey perfectly adapted to the laptop/tablet environment, Mercanet provides its mobile SDK tool. This tool enables your application to easily accept means of payment and optimise your customers’ shopping journey, in a secure environment that complies with the PCI DSS standard. In-App is compatible with iOS and Android environments.

Transactions and operations in message mode: Office (M2M)

Office (M2M) is an interface that works through a server-to-server dialog. It enables you to manage your own payment pages as well as your own management interface. This interfacing mode provides you with numerous advantages:

- There is no need to install and run an application on your infrastructures, which makes your system more flexible and reduces deployment time.

- Exchanges are based on standardised protocols widely used on the Internet; therefore, interfacing the systems is easier and quicker.

- The services are associated with a versioning system that can update them in a completely seamless way for the merchant systems that connect to them.

If you use Office (M2M) for payment, you have chosen to capture your customers' payment data yourself before sending this data to Office (M2M). Therefore, you will have to develop the interfacing with your customers, and handle the security and regulatory aspects accordingly.

For cash management, operations (refunds, cancellations, etc.) are always carried out using transaction aliases, which enables you not to use or keep sensitive data (card numbers, account numbers), thus freeing you from PCI DSS constraints.

File-based transactions and operations: Office Batch

The Office Batch interface enables you to build transaction and operation files, and then upload them to a secure FTP account. Office Batch notably enables you to perform mass cash management operations, but also recurring payment and subscription.

It must be noted that the syntax of Office Batch and Office (M2M) requests is almost identical. When constructing requests, only the specificities due to the technical interfaces will differentiate them. This greatly facilitates the transition from one to the other for complementary uses.

Merchant Extranet: Mercanet Back Office

Mercanet Back Office is a secure Web interface (https).

You only need some basic Internet access, and you use your username and password to access your dedicated interface.

You can do some cash management or trigger a payment. The latter function is especially useful if you take orders over the phone or receive purchase orders.

Comparison between Paypage and Office (M2M)

| Criterion | Paypage interface | Office (M2M) interface |

| Functional scope | Transaction creation only. | Transaction creation and cash management. Please note you can use Paypage for payment and Office (M2M) for cash management. |

| PCI DSS | Benefits from PCI certification because the payment process is outsourced to the Mercanet servers. You do not have to know the customer's PAN. |

In the case of transaction creation, payment pages

management is done on your premises; therefore, you are subject to

the PCI DSS certification. Tip: you can limit your

scope by not storing any PAN information in your information

system (e.g. by replacing the PAN with a wallet ID or a hashPan). |

| 3-D Secure | 3-D Secure process handled by Mercanet and seamless for you. | You drive the 3-D Secure authentication process. You

may also use Mercanet and another PSP to process

your authentication and authorisation requests, dispatching them

as you need. |

| Integration effort | Plug & Play solution that is easy to integrate. | Solution that requires more development work: payment on the merchant side with management of the payment pages |

| Adding a means of payment | No development work for you in most cases. Note: sometimes,

you must fill in specific fields in the payment request in order

to benefit from the options of the means of payment (e.g.

PayPal). |

Development work is required to integrate the means of payment (process management, page management, etc.). |

| Customer journey | Limited difference between your website and the payment server through your customisation (CSS, URL) of the payment pages. | No difference between your website and the payment server. |

| Integration into your IS | Interfaces with your shop. | Interfaces with your shop for transaction creation and/or your Back Office for cash management. |

| Reporting | Standardised reporting. | Standardised reporting. |

Page customisation tool: CustomPages

CustomPages is a Web interface that enables you to customise the pages hosted on the Mercanet server. With this tool you can:

- customise your payment pages in accordance with your graphic charter

- customise your wallet management pages in accordance with your graphic charter

- preview the look of these pages

- trigger the installation of your customisation elements (CSS, images, header, footer) into the production environment

Security

PCI DSS programme

PCI DSS is an international security standard that aims to ensure the confidentiality and integrity of cardholders’ data, and thus to secure card and transaction data. Merchants as well as payment providers must comply with it to varying degrees depending on the importance of their business. Mercanet solution has been PCI DSS-certified since 2006. You are also required to comply with this security standard. We suggest you discuss this subject with your acquiring institution.

With Mercanet, you can operate on multiple channels (Internet, phone, mobile) and provide payment facilities, payment by subscription or in instalments without having to know cardholders’ sensitive data. This greatly facilitates your PCI DSS certification process.

Mercanet helps merchants, as much as possible, to comply with this standard:

- through the Paypage interface -> the merchant does not know the cardholders’ data

- through the very advanced customisation offered on these payment pages secured by Mercanet, from graphic customisation to that of the payment URL

- through the payment facilities proposed (payment deferred until shipment, payment in instalments) from a transaction ID

- through the subscription and recurring payment features available

Securing payments

Mercanet offers several payment securing techniques:

| Technique | Description | Benefits | Shortcomings | PCI DSS Self-Assessment Questionnaire |

|---|---|---|---|---|

| Payment via Paypage. |

|

|

|

SAQ-A |

| Payment via Paypage iFrame. |

|

|

|

SAQ-A |

| MOTO payment via Paypage. |

|

|

|

SAQ-D |

| Payment via Office (M2M). |

|

|

|

SAQ-D |

| MOTO payment via Mercanet Back Office. |

|

|

|

SAQ-D |

Security of exchanges

The security of Mercanet is based on four essential pillars:

- merchant authentication

- authorisation request made to the cardholder’s bank

- confidentiality of the data, which is transmitted on the Internet in an encrypted form (card number, validity date, etc.)

- data integrity to prevent any alteration of the messages exchanged

In order to secure the online payment process, you share a secret key with Mercanet, which enables the latter to authenticate you when you call Paypage.

You are responsible for preserving this key and you must take every appropriate measures to:

- save it in an encrypted form

- never copy it to a non-secure disk

- restrict access to it

- never send it using a non-secure method (electronic or postal mail)

A secret key compromised and used by a malicious third party would disrupt the standard operation of the shop, and could notably generate unjustified transactions on your site or cause transaction management operations (e.g. refunds). Also, in case the key is compromised, you are required to ask as quickly as possible for its revocation and renewal from our customer support.

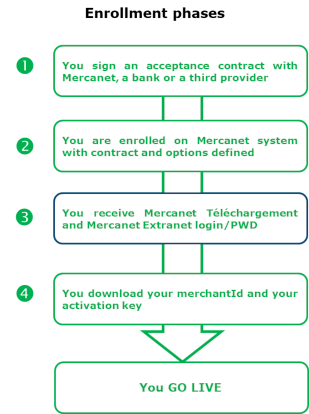

Implementation

To implement Mercanet, you must first sign contracts with various acquirers or service providers.

You will then have to choose your connectors and integrate them so you can connect your merchant site to the Mercanet payment server.

After a test phase, you will be able to open your site to the public and enable your customers to make purchases and pay for them.

Contracts

The use of Mercanet requires that you first sign one (or more) acquiring contract(s) with BNP Paribas, according to the means of payment of your choosing.

To accept multiple currencies, you must contact your banking or financial institution. Mercanet supports the most commonly accepted currencies in the world.

Implementation

This guide includes an interface comparison table that enables you to choose the interfaces adapted to your specific characteristics.

Depending on the chosen interface:

- You will need to implement the communication between your server (Front Office and/or Back Office) and Mercanet. This implementation is detailed in the connector guides.

- You (or your service provider) must comply with the PCI DSS regulation.

Tests and go-live

Shops are always registered with your actual merchant ID; however, in the test environment, you use an ID and a secret simulation key provided in the documentation and shared by the various merchants. This test environment, also called simulation mode, enables you to validate your developments and thus the integration of connectors between the website and the payment platform. At the end of these tests, your shop is activated in the production environment.

Find out more

The following guides will provide you with further information for an even more advanced implementation of the Mercanet solution. This is not a comprehensive list.

| Guide | Why read it? |

| Data Dictionary | This guide provides you with the definitions and values of connector and report fields. |

| Functionality setup guide | This guide explains how to implement Mercanet features. |

| Reports description | This guide describes the content of the reports sent by Mercanet. |

| Paypage eShop customisation and CustomPagesCustomPages | These guides explain how to customise your payment pages so their graphic charter is similar to the rest of your site. |

| OneClick payment | This guide describes the OneClick solution that enables your customers to pay with one single click without having to re-enter their card data. |

| Mercanet Message | This guide explains how to implement the Mercanet Message solution that enables you to send your customers payment notifications via e-mail or text message. |

| Mercanet Téléchargement | This guide explains how to download the documentation and your secret key via the Mercanet Téléchargement extranet. |

| Mercanet Back Office | This guide describes all the cash management actions you can perform through the Mercanet Back Office. |

| Fraud risk management - Go-No-Go and Business Score | These guides explain the operation, configuration and use of the Go-No-Go anti-fraud engine and the Business Score system. They enable you to define the fraud acceptance rules you want to set up during payments. |

| Paypage and Office (M2M) | These guides describe and explain how to implement the full set of Mercanet connector options. |

| Means of payment integration guides | These guides exist for each means of payment and describe in detail their specific characteristics, life cycles and processes. |